Not shown here are the handful of companies exhibiting the new fifth dimension of value Deep-Connect including BMW, IKEA, Patagonia, Tesla, Unilever, Walmart and the White Arena Group in the Laax ski resort in Switzerland.

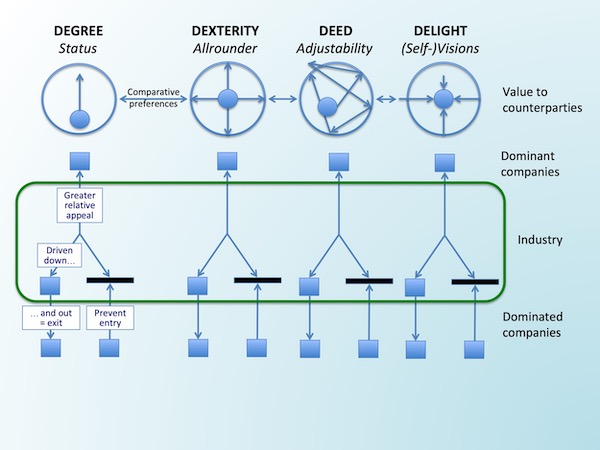

The diverging competitive fortunes of dominant and dominated companies in an industry is documented for the European automobile market in the third chapter of The Complex Diversity of Mastering 5-D Value Management at BMW, Daimler, Fiat, PSA, Renault and Volkswagen. These six European auto companies rose to dominance over the past 50 years in the course of two waves of consolidation. The firms emerged from shakeouts in the six largest national markets which occurred largely in 1960s – 1970s, quantified for each national market. The companies then expanded around the turn of the century in the course of the second consolidation at the European level.